dallas texas local sales tax rate

The average combined tax rate is 817 ranking 12th in the US. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

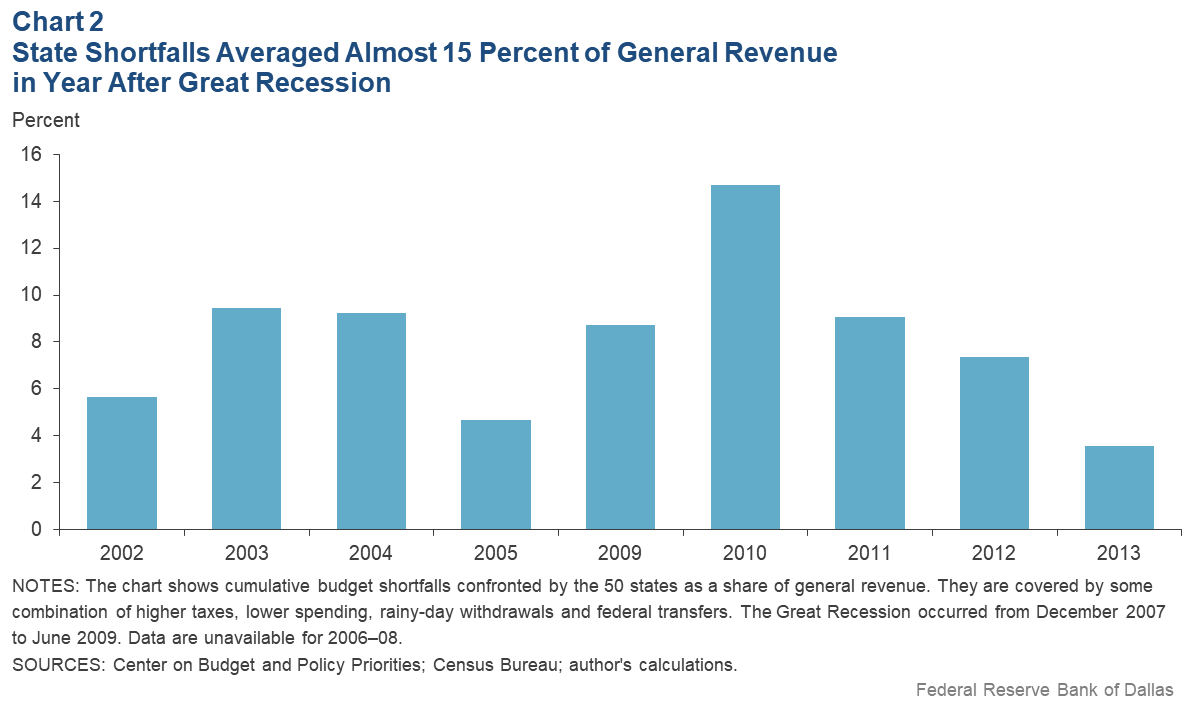

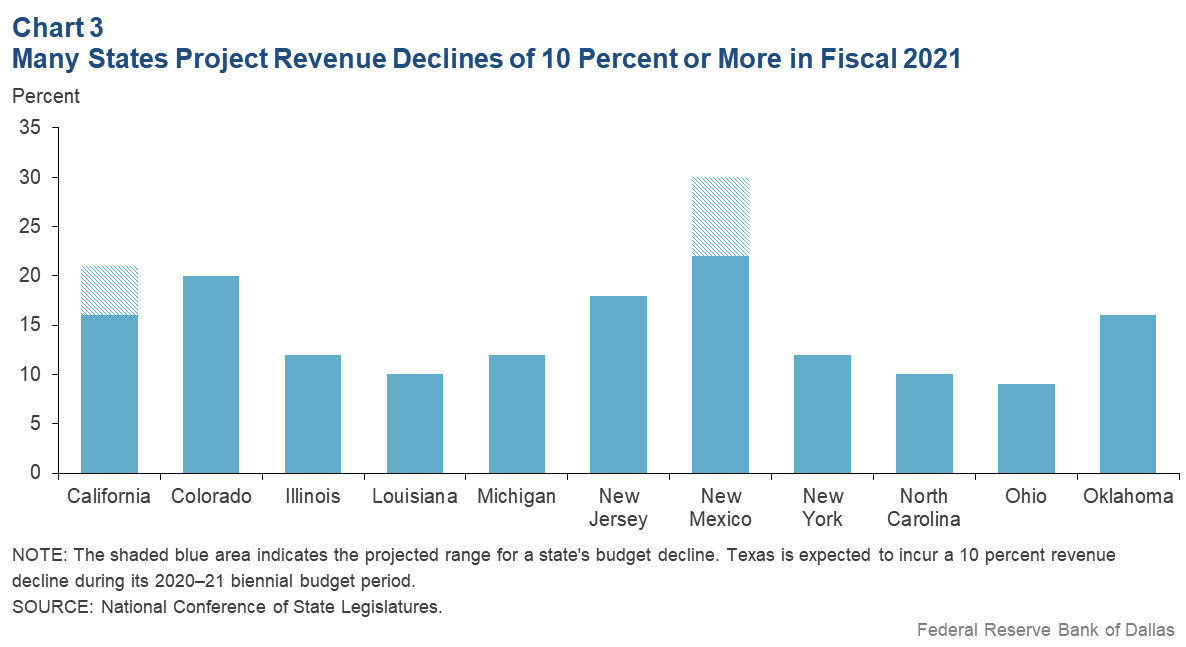

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

The Dallas Texas sales tax is 625 the same as the Texas state sales tax.

. Adkins Bexar Co 082500. 2021 Tax Rates Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. The current total local sales tax rate in Dallas County TX is 6250.

The latest sales tax rate for Dallas TX. 2020 rates included for use while preparing your income tax deduction. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

The top 12 city sales and. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes.

There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. US Sales Tax Texas Dallas Sales Tax calculator Dallas.

Wayfair Inc affect Texas. Dallas TX Sales Tax Rate. The December 2020 total local sales tax.

Ad Lookup TX Sales Tax Rates By Zip. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. The Texas TX state sales tax rate is currently 625 ranking 13th-highest in the US.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. This is the total of state county and city sales tax rates. Sales and use tax rates in the Houston region vary by city.

City sales and use tax codes and rates. TX Sales Tax Rates by City. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example.

Free Unlimited Searches Try Now. Texas ranked 33rd among all 50 states WalletHub stated. Texas Sales Use Tax Information.

This is the total of state and county sales tax rates. The current total local sales tax rate in Dallas TX is 8250. Counties cities and districts impose their own local taxes.

The minimum combined 2022 sales tax rate for Dallas County Texas is. There is no applicable county tax. The Dallas County sales tax rate is.

Local Code Local Rate Total Rate. How much are taxes in Dallas Texas. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose a sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. With local taxes the total sales tax rate is between 6250 and 8250. Calculator for Sales Tax in the Dallas.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. This table shows the total sales tax rates for all cities and towns in Dallas County including all local taxes. 2020 rates included for use while preparing your income tax deduction.

The Dallas sales tax rate is. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. The state sales tax rate in Texas is 6250.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. Texas has a 625 sales tax and Dallam County collects an additional NA so the minimum sales tax rate in Dallam County is 625 not including any city or special district taxesThis table shows the total sales. The current total texas law enforcement local sales tax rate in Dallas TX is 8250The december 2018 total local sales tax rate was also 8250.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. The County sales tax rate is. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825.

You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables. To make matters worse rates in most major cities reach this limit. 104 rows 2021 Tax Rates.

Dallas collects the maximum legal local sales tax. There is base sales tax by Texas. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas.

Rates include state county and city taxes. For tax rates in other cities see Texas sales taxes by city and county. Local taxes apply to both intra-state and.

TX Rates Calculator Table. You can print a 825 sales tax table here. To make matters worse rates in most major cities reach this limit.

Texas has recent. The world-famous city of Dallas is situated within multiple. Depending on local municipalities the total tax rate can be as high as 825.

This rate includes any state county city and local sales taxes. Did South Dakota v. The minimum combined 2022 sales tax rate for Dallas Texas is.

The Texas sales tax rate is currently. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825. The average local rate is 192.

The minimum combined 2022 sales tax rate for Lake Dallas Texas is 825. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

The Texas state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in Dallas County.

The results are rounded to two decimals. Texas Sales Tax. Fill in price either with or without sales tax.

The latest sales tax rates for cities in Texas TX state. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Texas Comptroller of Public Accounts.

How To Charge Your Customers The Correct Sales Tax Rates

2021 2022 Tax Information Euless Tx

Which Texas Mega City Has Adopted The Highest Property Tax Rate

How To Charge Your Customers The Correct Sales Tax Rates

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

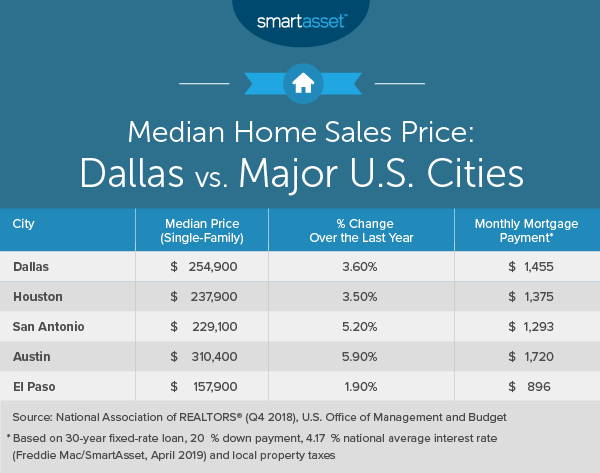

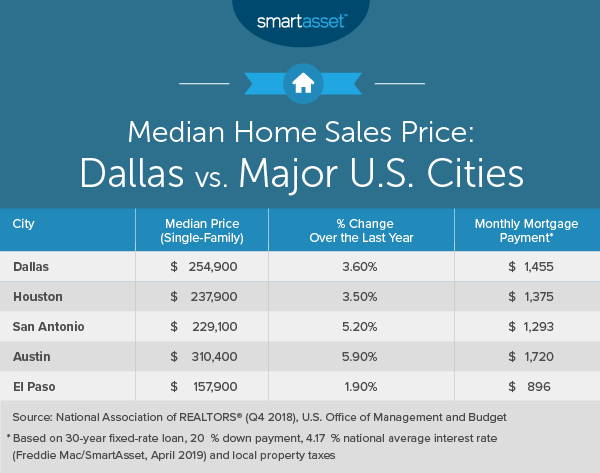

Cost Of Living In Dallas Smartasset

Why Are Texas Property Taxes So High Home Tax Solutions

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

How To File And Pay Sales Tax In Texas Taxvalet

Texas Sales Tax Guide For Businesses

How To File And Pay Sales Tax In Texas Taxvalet

Texas Sales Tax In 2017 What You Need To Know The Motley Fool

Tax Rates Richardson Economic Development Partnership

Texas Sales Tax Rates By City County 2022

Texas Sales Tax Guide And Calculator 2022 Taxjar

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org